Shareholder Return Policy

UT Group’s unique shareholder return policy is as follows.

01Shareholder Return Policy

UT Group’s business objective is to continuously improve its sustainable corporate value by ensuring a stable financial base and achieving high growth driven by active business development. We also recognize returning profits to our shareholders as a key management issue. In May 2025, we decided to change our shareholder return policy with the aim of further enhancing returns to shareholders. As of November 2024, our policy was to allocate 60% of profit attributable to owners of parent as dividends and the remaining 40% as a source for human capital investments, which serve as a growth driver. However, in the next fiscal year, given that human capital investments will be treated as personnel expenses in accounting and that we have a good prospect of securing funds necessary for business operations during the plan period, we will return profits to shareholders with a dividend payout ratio of 100%, based on profit attributable to owners of parent after human capital investments.

Dividends / Net earnings ≧100%

02A system that enables each associate to be aware of his or her own growth and the Company’s growth

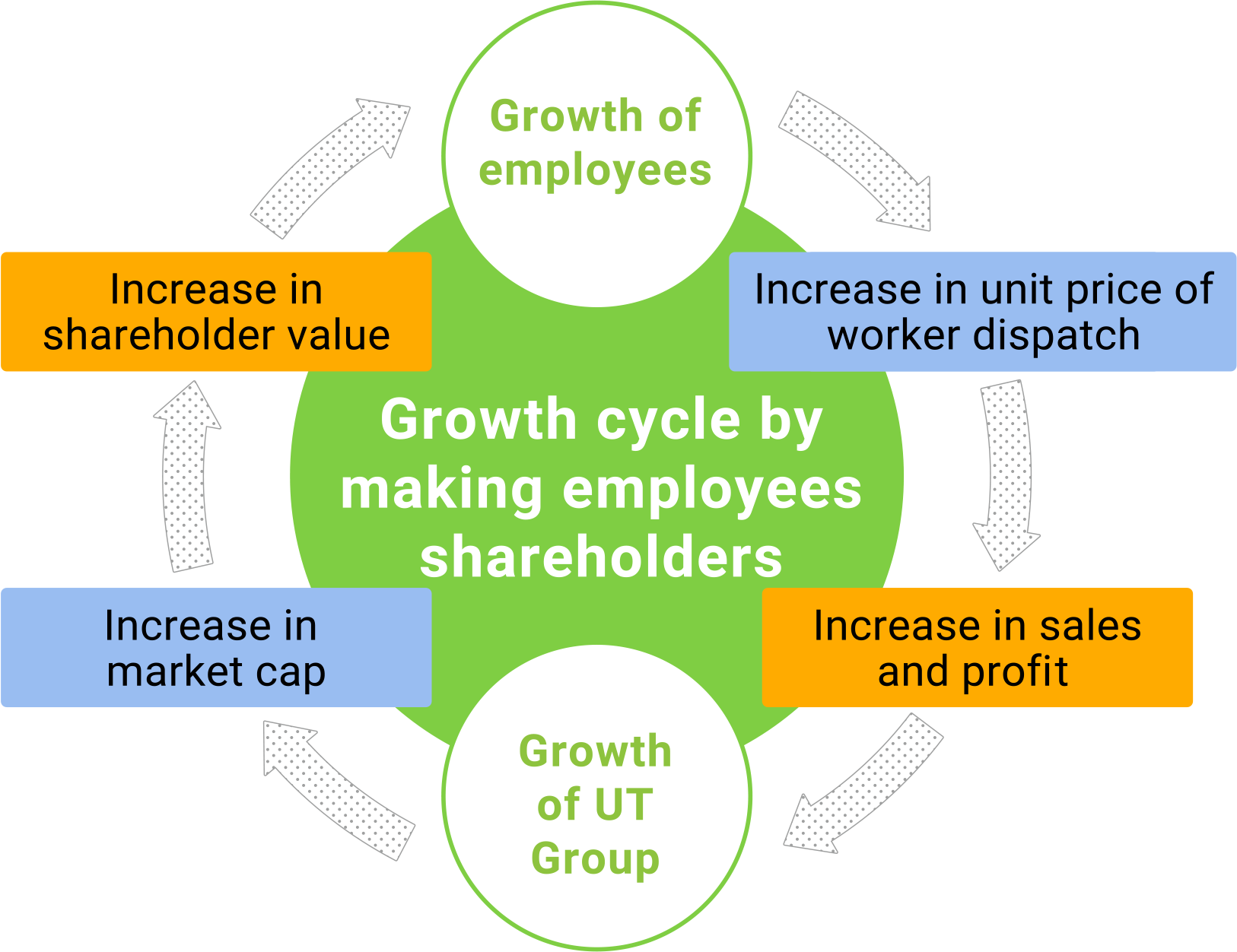

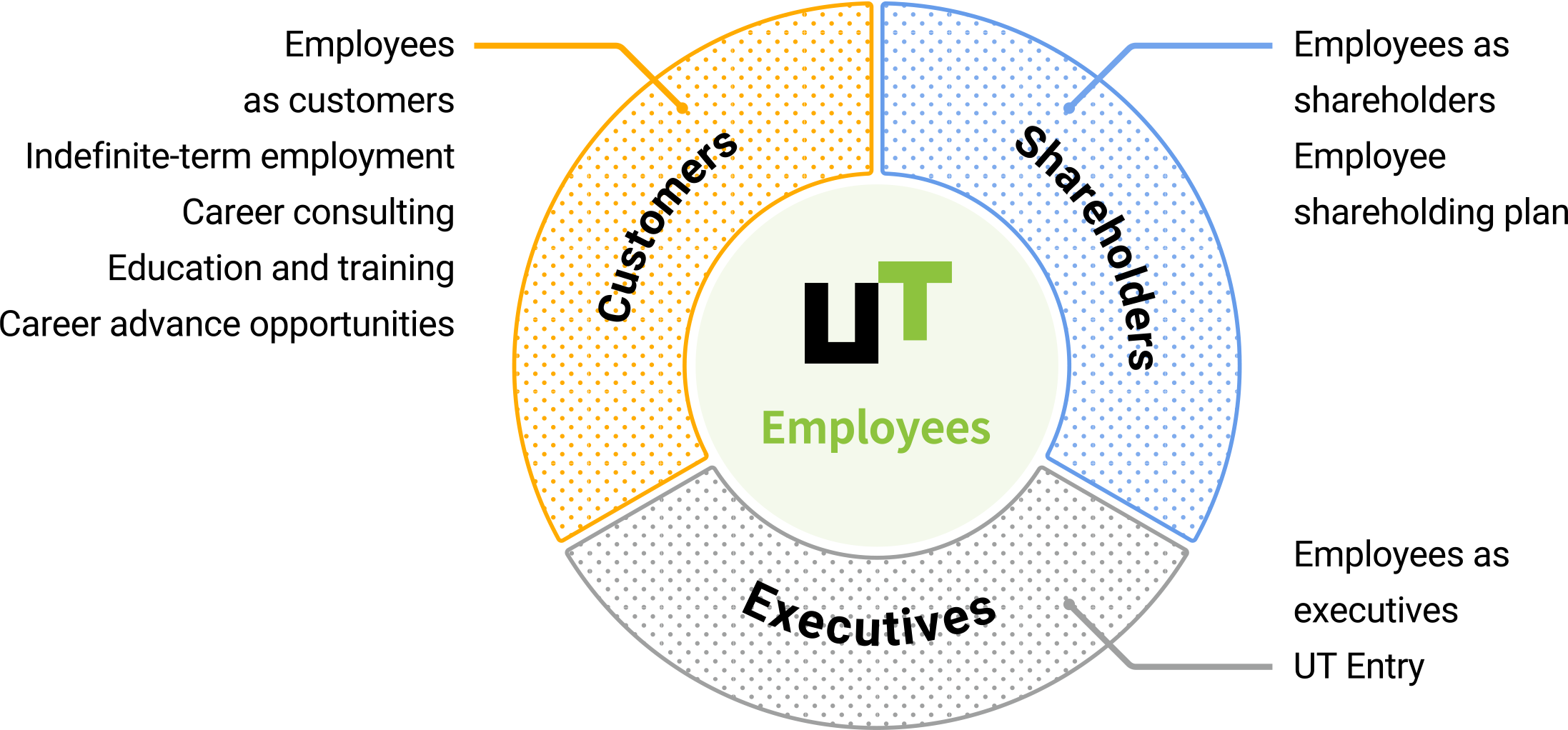

UT Group’s policy to support its workers has not been changed since UT’s foundation. Associates (a term for employees at UT Group) enhance their skills and therefore their value, which leads to higher unit prices, higher salaries, and higher sales and profit of the Company. We also assist associates to become UT Group’s shareholders in order to make them feel the impact of their efforts in growth of the Company and to support their long-term asset formation by participating in the Employee Shareholding Plan.

03Dispatch workers play a main role of UT Group and that is why it attracts people and realizes growth

In keeping with the mission to “create vigorous workplaces empowering workers”, UT Group has created a cycle in which workers play a key role, manage the organization, and support other workers. UT Group’s workers include dispatch workers who work at our client companies’ site and associates who support business as administrative or office staff. In the management team, roughly one half has the experience of having been a dispatched worker. UT Group’s workers can also be its shareholders through the employee shareholding plan. That is why we say that our associates are our customers, managers, and shareholders. This is another reason why UT Group continues to realize growth.

04Please support UT’s cycle, which helps us achieve sustained profit growth

We believe that UT Group’s growth cycle works when our associates, management and shareholders all aim at the Company’s sustainable growth. To achieve this, we believe that our shareholders need to realize the benefit of profit generated by the Company through its growth, which stems from the growth of each associate. Based on this concept, UT Group positions continuous return on profits to shareholders as an important management policy. The Company will deliver steady return through dividend payments with a “payout ratio of 60%.”

Please support UT’s cycle of sustainable growth.